Smart city investments are consolidating around operationally critical, revenue-linked use cases rather than experimental pilots. This shift will favour IoT vendors able to prove lifecycle cost savings, interoperable platforms and robust device management at municipal scale. Diverging regional dynamics – mature but fragmented European demand versus hyper-centralised programs in the Middle East and Asia-Pacific – will shape different procurement models and partnership structures. Overall, these trends reinforce a move toward infrastructure-grade IoT, tightly coupled to city budgeting, regulation and resilience planning.

Europe leads adoption while Middle East and Asia-Pacific post fastest growth, as smart lighting, waste, parking and surveillance scale toward 2029

Berg Insight, the world’s leading IoT market research provider, today released the latest edition of its comprehensive smart city technology report comprising in-depth studies of five key technology areas – smart street lighting, smart parking, smart waste collection, urban air quality monitoring and smart city surveillance.

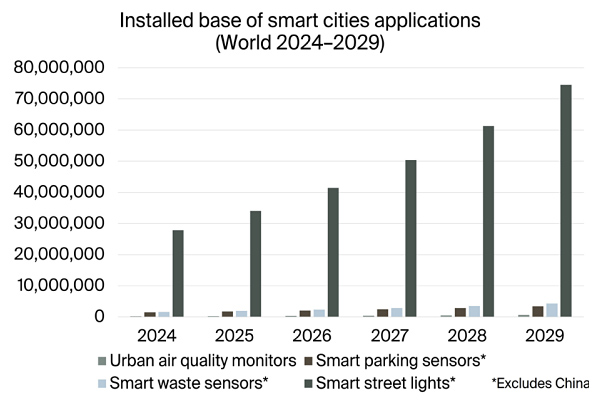

In 2024, the global installed base (excluding China) of individually controlled smart street lights amounted to 27.9 million units. The corresponding figures for the smart waste and smart parking sensor technology markets were at the same time 1.56 million and 1.47 million units respectively. Smart parking sensors refers to in-ground or surface-mounted parking occupancy detection sensors while smart waste sensor technology consists of fill-level sensor devices that may either be pre-integrated into bins and containers, for example as a smart bin offering, or retrofitted on existing collection points.

The smart street lighting market has now gained significant traction and its installed base will grow at a CAGR of 21.8 percent to reach 74.5 million units in 2029. The number of installed smart parking sensors is expected to see a slightly slower growth of 18.4 percent (CAGR) while the smart waste sensor technology market will be the fastest growing of the three with a CAGR of 22.3 percent.

Another smart city technology area is the field of non-regulatory urban air quality monitoring, which comprises increasingly small and low-cost air quality monitoring devices that can serve as valuable complements to traditional regulatory monitoring stations. At the end of 2024, the number of such non-regulatory air quality monitoring devices installed in outdoor urban environments amounted to 206,000 units globally and will reach 633,000 units in 2029.

The largest of the five covered smart city application areas was meanwhile the smart city surveillance market, which reached a global market value of € 13.6 billion in 2024. The market, which includes both fixed and mobile video and audio surveillance solutions, is expected to grow at a CAGR of 15.6 percent throughout the forecast period.

Outside China, Europe has emerged as the leading smart city technology adopter while North America constitutes the second largest market. The Middle East and Asia-Pacific regions meanwhile constitute the fastest growing markets for smart city technology, fuelled by ambitious top-down initiatives and rapid urbanisation.

“Overall, the demand for remotely managed infrastructure continues to increase day by day, paving the way for a more sustainable and resilient future for city services”, said William Ankreus, IoT analyst, Berg Insight.

There are great opportunities for growth within all the separate application areas and market conditions are increasingly supportive of large-scale smart city deployments.

Mr. Ankreus concluded:

“Cities and municipalities are now prioritising ROI, operational savings and service quality over technology-led experimentation, accelerating the adoption of digital solutions that deliver tangible outcomes.”

The post Smart city technologies gain global momentum across core urban services appeared first on IoT Business News.