The fate of hundreds of billions’ worth of clean energy tax credits is among the last unresolved big-ticket items Republicans are hashing out before a series of planned committee markups on their big budget bill.

The Agriculture, Energy and Commerce, and Ways and Means committees are hoping to advance their portions of the party-line tax and spending package next week. Language could begin trickling out as soon as Friday.

But negotiators say haggling is still happening on what to do with renewable energy incentives and other credits from the Democrats’ 2022 climate law, which are benefiting red districts and states across the country. Ways and Means has jurisdiction over those programs.

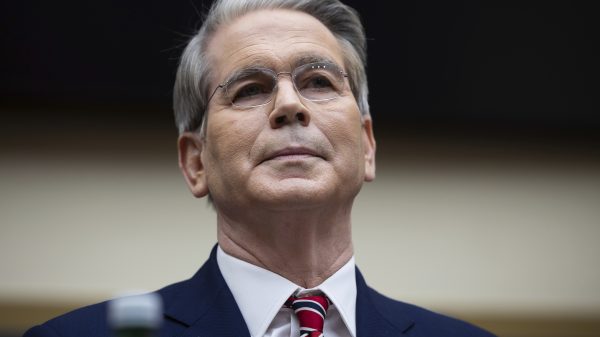

“I’ve heard from people in Ways and Means there is a lot of disagreement in the room,” said Rep. Andrew Garbarino (R-N.Y.), who has been helping lead the charge to protect at least some of the credits. “It’s one of the things that’s the most contentious in the room.”

Seeking to put a marker down for where Republicans across the conference might be willing to compromise, Garbarino and Rep. Jen Kiggans (R-Va.) have introduced the “Certainty for Our Energy Future Act.” It would phase out solar and wind incentives, disqualify companies tied to foreign adversaries and preserve the ability of businesses to buy and sell certain clean energy credits — a practice known as “transferability.”

Republican Reps. Dan Newhouse of Washington, David Valadao of California and Mark Amodei of Nevada have also signed on to the legislation.

“The goal was to find a place that people could live with,” said a Kiggans aide granted anonymity to speak about internal deliberations. The aide also called it a “starting point” and a “best-case scenario” as this group of Republicans and nearly two dozen others go up against hard-liners who want a full repeal of the suite of clean energy tax credits codified by the Inflation Reduction Act, which President Donald Trump likes to call the “Green New Scam.”

Every vote counts for Speaker Mike Johnson as he seeks to pass a hyperpartisan bill through his razor-thin Republican majority, giving members an inordinate amount of power to make demands. A major question, however, is how far Republicans are willing to go in expending political capital to defend the energy incentives.

There are other priorities Republicans are fighting for, too, and they could take precedence — for instance, there’s overlap among the lawmakers who want to protect the tax credits and those who are simultaneously locked in a fierce battle to increase the income tax deduction for state and local taxes.

“I’m much more passionate about SALT; it is a hill I’m willing to stake my entire congressional career on,” said Rep. Nick LaLota (R-N.Y.). Asked whether that applied to clean energy incentives, too, he said, “No.”

“I’m interested in them; I don’t think we should throw out the entire IRA,” LaLota said. “There are provisions in it which I think are good for the country, are good for my constituents. But I am all in on SALT.”