The Treasury Department said Friday it would likely run out of cash to pay the nation’s bills by August, setting a new, firmer deadline for Congress to act to avoid a catastrophic default on the United States’ more-than $36 trillion debt.

That date could also become the new, de facto deadline for congressional Republicans to pass their megabill of tax cuts, border security investments and energy policy, assuming leadership sticks with its plan to approve a $5 trillion debt limit hike as part of that package.

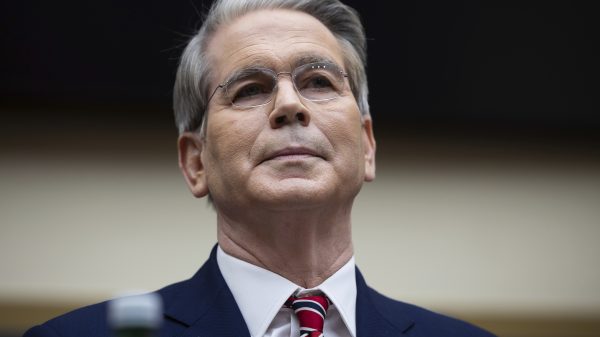

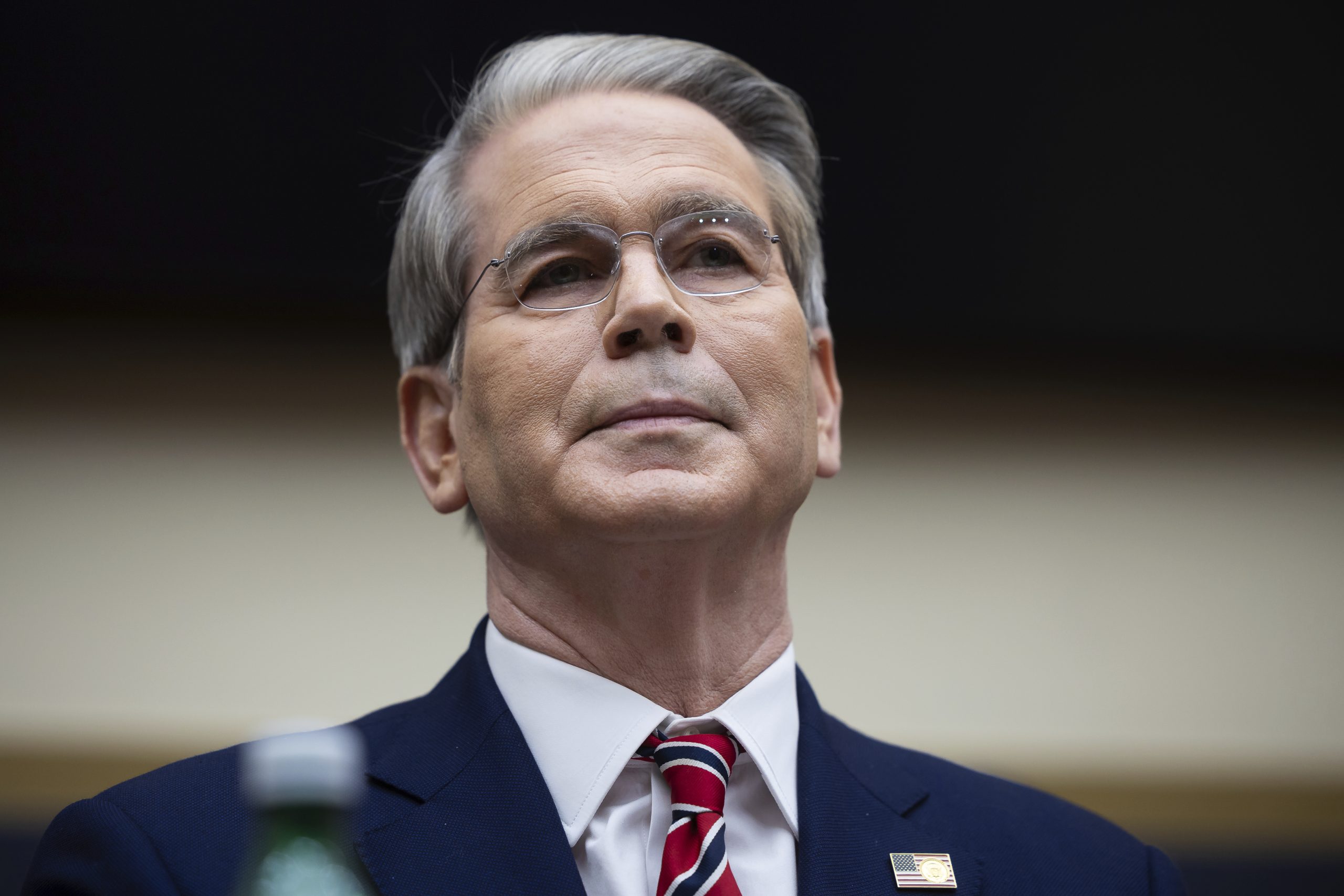

Treasury Secretary Scott Bessent wrote in a letter to congressional leaders that “there is a reasonable probability” the government’s cash “will be exhausted in August while Congress is scheduled to be in recess,” urging Congress to increase or suspend the debt limit by mid-July “to protect the full faith and credit of the United States.”

The pressure to prevent a first-ever U.S. debt default could help GOP leaders whip support for the final package they are trying to steer past the Senate filibuster.

“A failure to suspend or increase the debt limit would wreak havoc on our financial system and diminish America’s security and global leadership position,” Bessent warned Friday.

If congressional Republicans don’t get their party-line bill to President Donald Trump’s desk before Treasury exhausts its borrowing power, GOP leaders will likely be forced to seek votes from Democrats to head off the fiscal cliff — an exercise that would likely require making major policy concessions to the minority party and risk alienating fiscal hawks.

In the meantime, still buoyed by the surge of revenue from tax season, the Treasury Department is due to get another cash bump in mid-June when quarterly tax receipts flow in from corporations, self-employed people and some other filers.

Then Bessent will be able to extract more borrowing power in late-June from a key federal retirement fund. That’s just one of the typical “extraordinary measures” Treasury has been using to keep the U.S. from defaulting on its loans since the debt limit was reinstated in January, as prescribed by a 2023 deal then-President Joe Biden struck with then-Speaker Kevin McCarthy.