EURUSD and GBPUSD: The Euro returns to the positive side

On Thursday, October 17, EURUSD retreated to 1.08112 to a new three-month low

During this morning’s Asian trading session, GBPUSD saw a bullish consolidation from the 1.30100 level

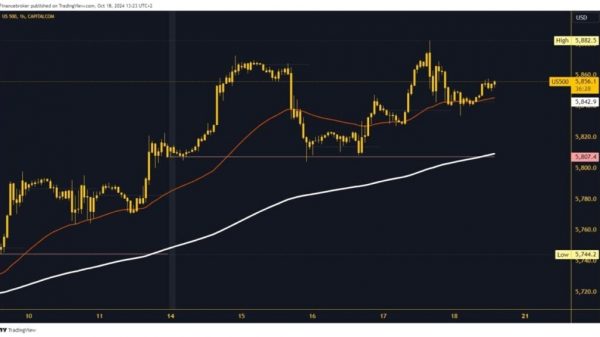

EURUSD chart analysis

On Thursday October 17, EURUSD retreated to 1.08112 to a new three-month low. The pair managed to stop further retreat and start recovery. During this morning’s Asian trading session, the Euro continued to rise to 1.08500. In the zone of that level, we encounter the EMA 50 moving average, which has been a constant resistance for us this week. This time, we expect a break above and the formation of a new daily high.

Potential higher targets are 1.08600 and 1.08700 levels. For a bearish option, EURUSD would have to turn to the bearish side again. The important level is the 1.08300 daily open price. By breaking below, we go to a new daily low and strengthen the bearish momentum. Potential lower targets are 1.08200 and 1.08100 levels.

GBPUSD chart analysis

During this morning’s Asian trading session, GBPUSD saw a bullish consolidation from the 1.30100 level. At the start of the EU session, we saw a bullish impulse to 1.30700 to a new daily high. With that jump, the pair tested the weekly open level and the EMA 200 moving average. In the first swing, we failed to hold and saw a pullback to 1.30300. GBPUSD starts a new bullish momentum from this support level and has a new chance to return above the EMA 200 and the weekly open level to the positive side.

Potential higher targets are 1.30800 and 1.30900 levels. For a bearish option, the pair should encounter resistance in the 1.30500 zone. After that, we expect the initiation of bearish consolidation below 1.30300 and a drop to 1.30200. There, we will test the EMA 50 moving average in the hope of stopping further decline. A break below means a continuation to the bearish side and the formation of a new low. Potential lower targets are 1.30100 and 1.30000 levels.

The post EURUSD and GBPUSD: The Euro returns to the positive side appeared first on FinanceBrokerage.